do you pay taxes when you sell a car in texas

The Texas Comptroller also says that any Texas residents new or established and anyone that does. Even in the unlikely event that you sell your private car for more.

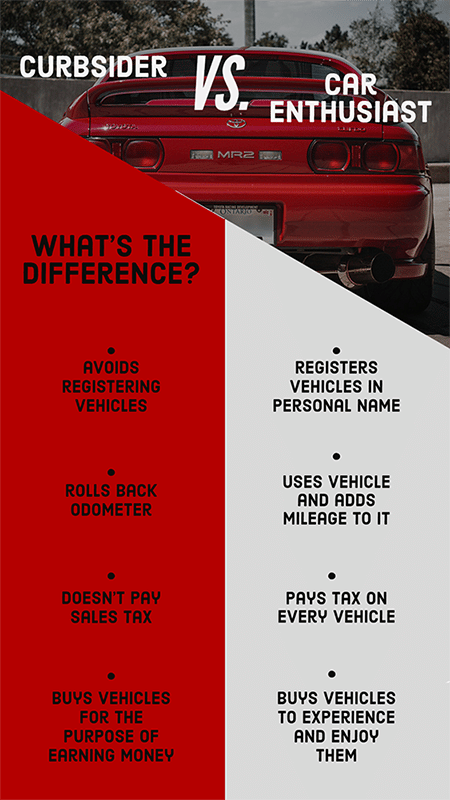

How Many Cars You Can Sell Without A Dealer S License Canadian Gearhead

If your trade-in is valued at 4000 and the new car is valued at 22000 youll only pay sales tax on the difference18000 in this case.

. While this question might seem a little complicated the answer is very straightforward and the simple answer is you dont have to pay taxes. Transferring the Title is essential. Toyota of Naperville says these county taxes are far.

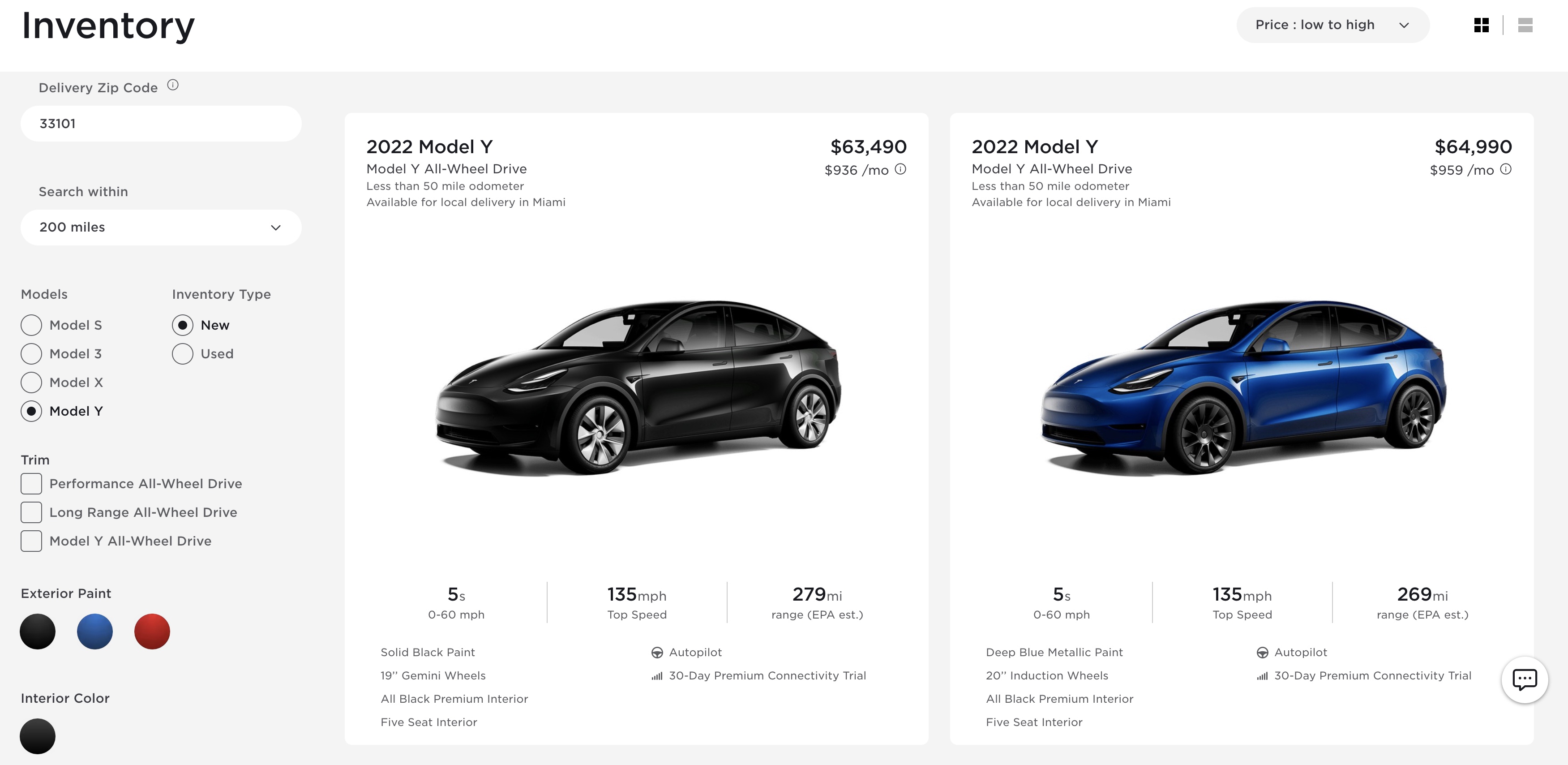

The Texas Department of Motor Vehicles affectionately refers to this as 130-U. There are some circumstances where you must pay taxes on a car sale. When you sell your car you must first reset it to delete all of your personal information and then remove it from your Tesla account to avoid being liable for supercharging.

The sales tax on a new car might be 5. What kind of tax do you pay on a car in Texas. The buyer is responsible for paying the sales tax.

Tax is calculated on the leasing companys purchase price. This tax is 625 of the sales tax. For example theres a state sales tax on the purchase of automobiles which is 725 and additional county taxes apply.

If as a resident of Texas you sell a car to someone in another state any sales tax is up to the buyer. Some states such as California charge use taxes when you bring in a car from out-of-state even if youve already paid the sales tax on the vehicle. You cannot purchase or sell a vehicle without it.

You dont have to pay any taxes when you sell a private car. Subtract what you sold the car for from the adjusted purchase price. In addition to the above sales tax can also be charged on a county or municipal level.

If the buyer is living in another state then the tax would need to be paid in that. The taxable value of private-party purchases of used motor vehicles may be based on the standard presumptive value. The sales tax for cars in Texas is 625 of the final sales price.

Texas residents 625 percent of sales price less credit for. The selling dealers signature on the title application is an acceptable record of the sales price. Thus you have to pay capital.

Selling a car for more than you have invested in it is considered a capital gain. Instead the buyer is. Although a car is considered a capital asset when you originally purchase it both state.

In case you were wondering 742 of 37851 is around 2808. You can determine the amount you are about to pay based on the Indiana excise tax table. Answered by Edmund King AA President.

In Oklahoma the excise tax is. If you spend 7000 on a car and an additional 1000 on improvements but you sell the car for 7000 its considered a capital loss and you dont need to pay tax on the sale. You do not need to pay sales tax when you are selling the vehicle.

Tax is imposed on the leasing companys Texas purchase of a motor vehicle and is due at the time of titling and registration. Per CarsDirect besides the sales tax Texans must pay what is known as a use tax. If the seller does not transfer or keep their license plates the license plates must be disposed of by defacing the front of the plates either with permanent black ink or another method in order.

When you sell a car for more than it is worth you do have to pay taxes. Thankfully the solution to this dilemma is pretty simple. So if you bought the car for 14000 and sold it for 8000 you would have a capitol loss of 6000.

The short answer is maybe. When you donate a car. For example if you bought the two-year-old SUV for the original retail price of 25000.

Car Tax By State Usa Manual Car Sales Tax Calculator

Sales Taxes In The United States Wikipedia

Do You Have To Pay Taxes On Your Car Every Year Carvana Blog

Tax Rules For Buying A Suv Or Truck To Deduct As A Business Expense

Gifting A Car How To Gift A Car To A Family Member Or Sell It For Profit

Car Tax By State Usa Manual Car Sales Tax Calculator

How Much Is Tax Title And License In Texas The Freeman Online

Free Bill Of Sale Forms 24 Word Pdf Eforms

What Small Business Owners Need To Know About Sales Tax

When I Sell My Car Do I Have To Pay Taxes Carvio

Can I Sell My Car To My Daughter For One Dollar Sapling

When Are Car Insurance Settlements Taxable Insurance Com

When I Sell My Car Do I Have To Pay Taxes Carvio

Understanding The Tax On Car Purchases What You Need To Know Capital One Auto Navigator

Tesla Expands Availability Of New Texas Built Model Y And Raises The Price Electrek

Texas Vehicle Sales Tax Fees Calculator Find The Best Car Price

/will-i-pay-tax-on-my-home-sale-2389003-v5-73871af4e690411c8fc3e03de02cb241.png)

Will I Pay Taxes When I Sell My Home